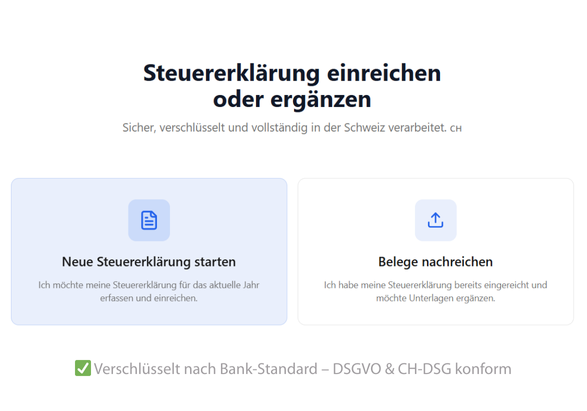

Your Tax Declaration

In just 3 steps to a completed tax return.

01

Start online questionnaire

A personalized checklist is generated based on the information provided.

02

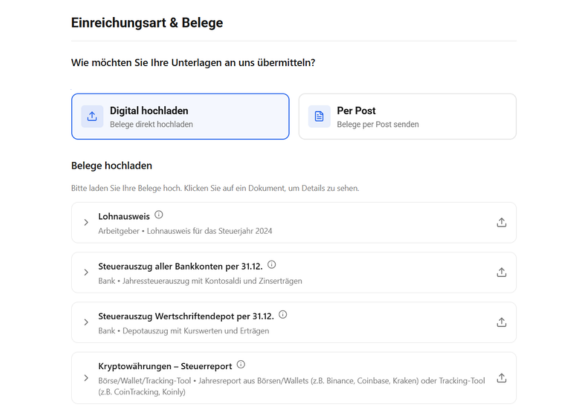

Submit documents

Quick and easy:

- Questionnaire generates checklist with necessary documents

- Upload documents online or

- Submit by mail with generated cover sheet

03

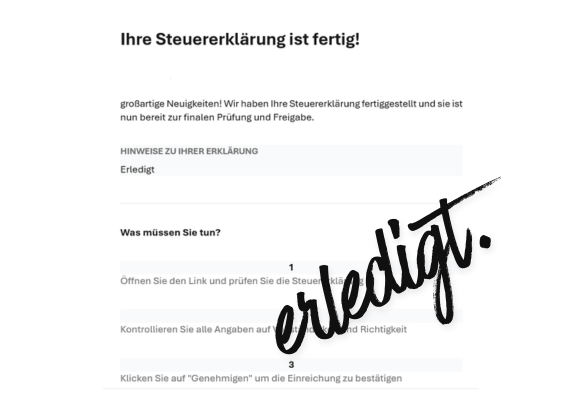

We Take Care of the Rest

Within 20-30 working days, you will receive the completed documents back electronically. You can choose whether you want to check the declaration before submission or have it completed directly.

Prices

Our prices are

transparent and fair.

For individuals

(without children, without properties)

(without children, without properties)

without ATG insurance mandate

CHF 130

With ATG insurance Mandate

CHF 110

Up to five account items (excluding securities)

Employed income with work-related expenses

Education and training costs

Medical expenses with tax certificate

Donations and party contributions

For individuals +

(with/without children, with properties)

(with/without children, with properties)

without ATG insurance mandate

CHF 160

With ATG insurance Mandate

CHF 140

Up to ten account and/or securities items

Employed income with work-related expenses

Education and training costs

Information on children with related expenses

Medical expenses with tax certificate

Donations and party contributions

Recording of owner-occupied property

For families

(for married couples)

(for married couples)

without ATG insurance mandate

CHF 195

With ATG insurance Mandate

CHF 170

Up to fifteen account and/or securities items

Employed income with work-related expenses

Information on children with related expenses

Education and training costs

Medical expenses with tax certificate

Donations and party contributions

Recording of owner-occupied property

Incomplete Documentation

surcharge

MIND. CHF 30.--

Bei Unklarheiten, falschen Belegen oder zwingend notwendigen Rückfragen

Charge when documents must be kept pending.

effective recording

Per invoice/document

CHF 5.--

Recording of actual property costs.

Recording of actual healthcare costs.

Additional securities positions.

Inheritances/Donations

Per case

CHF 25.--

Queries from the tax advisor.

Collection and management of data.

Complex data processing required.

Intercantonal Allocation

Per canton

CHF 30.--

Direct processing for each additional canton.

Consideration of cantonal tax rules.

Increased complexity due to multiple cantons.

Additional property

Per property, from 2nd property

CHF 55.--

Recording of lump-sum maintenance costs.

Management of rental income.

Extra effort for each additional property.

Additional services

Per hour, according to effort

CHF 122.50

Handling of email inquiries.

Administrative support.

General process-related questions

tax mandate

Per year

CHF 180.--

Representation before tax authorities.

Review of assessment notices and final tax bills.

Organization and forwarding of inquiries.

Express order

surcharge

CHF 75.--

Processing within 5 working days.

Priority handling of the tax return.

Urgent processing with quick feedback.

Consultation

per hour, according to effort

CHF 194.85

Tax advice by phone or in person

Tax calculations

Handling of other special tax cases (e.g. real estate capital gains tax)

Easily to Your Tax Return

In just 3 steps to your completed tax return

Ready to hand over the documents?

The checklist is generated using the questionnaire.

Have you understood the costs?

You have read the base prices and additional costs and agree to them.

.png)

.png)